Bank Hapoalim

Credit Card Application Flow

Background

Introduction:

From Classroom to Real Impact

”How might we transform the mobile credit card ordering experience into something seamless,

personal, and empowering?”

1. Immersion & Understanding the Problem

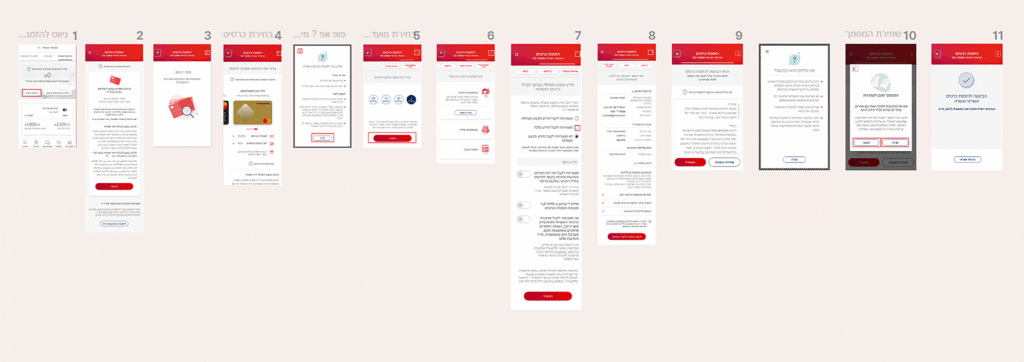

We started by mapping the existing flow, then stepped into the shoes of real users. Conversations, competitive benchmarking, and product deep-dives uncovered a number of pain points that made the experience feel frustrating and disconnected.

Hidden Onboarding process details No timeline or requirements

Identical-looking Card Selection options No personalization

Fixed Billing Dates No Financial Guidance

Complicated Delivery Issues Approval Issues, Strict Methods

2. Market Insights: Local & Global Inspiration

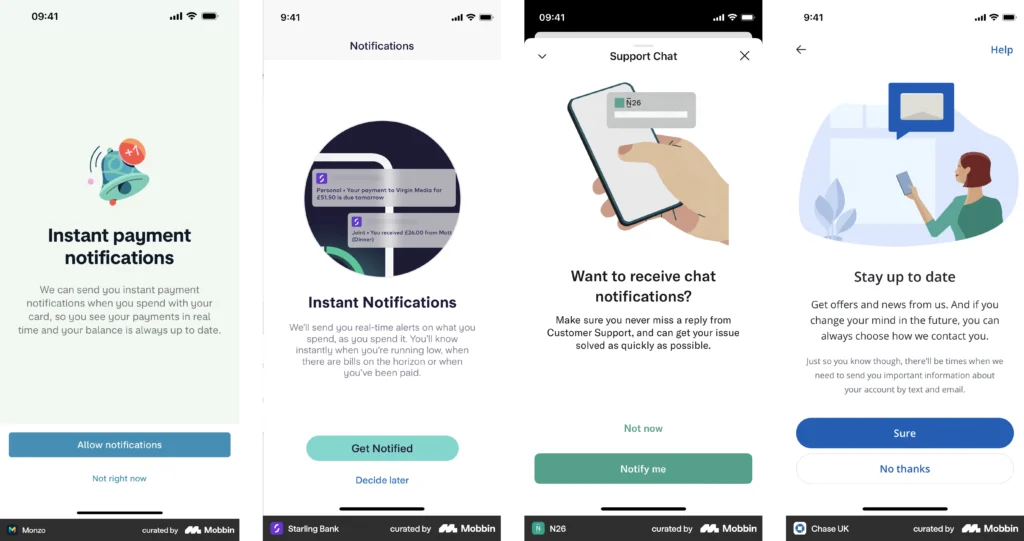

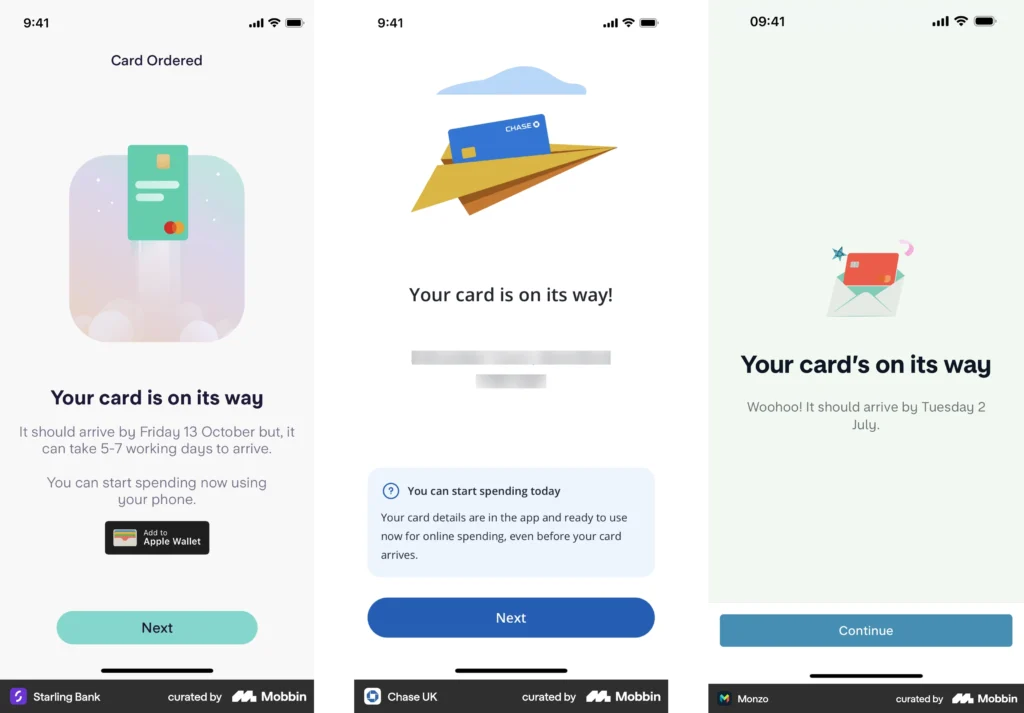

To reimagine the experience, we studied global leaders like N26, Revolut, Monzo, and Starling, alongside local competitors such as Discount Bank, Leumi, and Mizrahi-Tefahot.

3.Testing a Hypothesis: Do Tags Improve Experience?

We came up with the idea to personalize the credit card selection process by letting users choose interest-based tags. This would allow the system to recommend cards more relevant to their lifestyle and needs. To test this hypothesis, we created two versions of the flow:

Flow A:

A familiar version showing a generic list of cards

Flow B:

A personalized version, where users selected interest tags before receiving tailored card suggestions

We conducted A/B testing with over 20 participants. The results exceeded our expectations — an overwhelming majority of users preferred the personalized flow and said it made choosing a card easier, faster, and more relevant.

Real User Feedback:

“I liked that it’s personalized. I don’t need to read all the comparisons – I just choose what matters to me.”

“It feels like the bank understands me – I say what I want, and it gives me a solution.”

“I’m a student and don’t understand credit cards – this way it’s simple and easy.”

4. Final Design Highlights

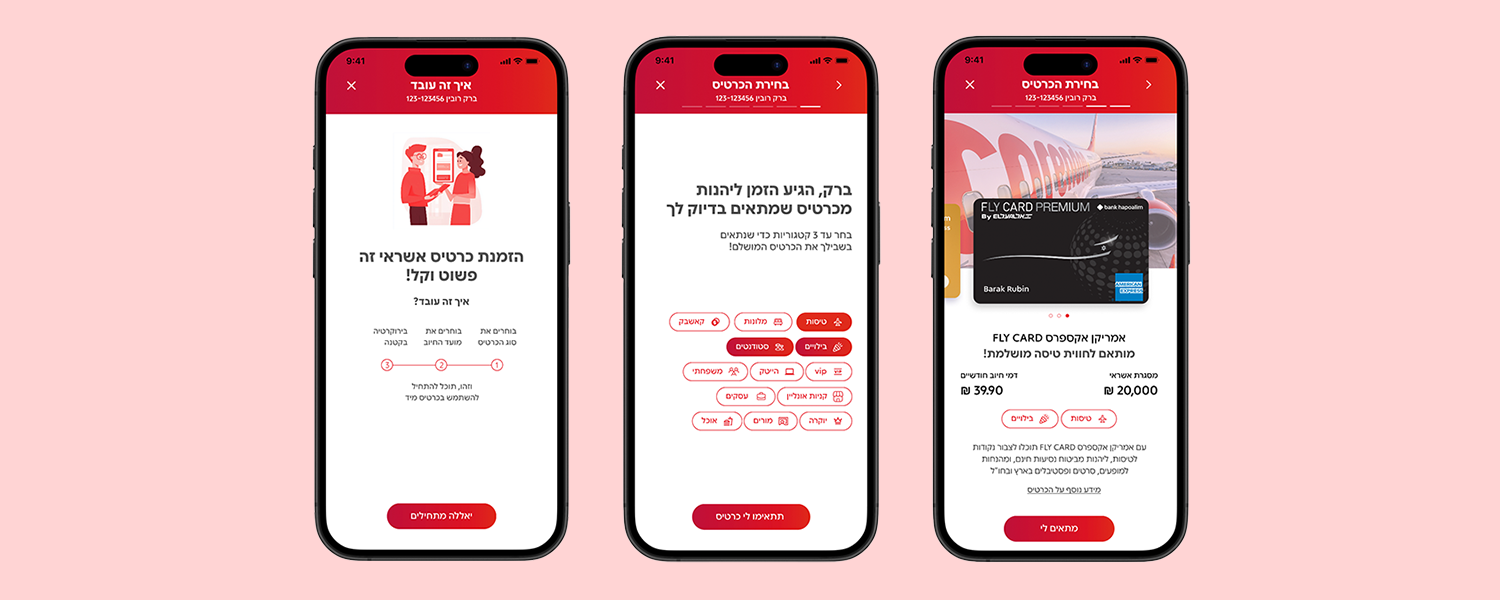

- Intro & Progress: Friendly intro screen with 3-step visual roadmap

- Tag-Based Personalization: Let users tell us who they are — we handle the complexity

- Card Selection: Lifestyle-based visuals, clear benefits, and confident copywriting

- Billing Date Guidance: Smart defaults + contextual explanations

- Direct Debit Prompt: Subtle nudge to make this the primary card

- Digital Wallet Integration: No skip — just flow

- Approval & Confirmation: Calm, clear finish that reinforces trust

5. Presenting to the Bank

Sharing our solution with senior leaders and department heads gave us valuable feedback — and confirmed the relevance and impact of our approach within the organization.